Big Decisions

I vividly remember my first desktop computer. It was a mighty machine powered by an AMD Athlon 800mhz processor with 64mb ram. As a true geek, I upgraded it several times and with respect to the graphics cards, there were only two choices at the turn of the century. You either went with AMD's Radeon chips or NVIDIA's GeForce range. My choice settled on a Radeon with 64mb; AMD was the underdog at the time, but their Radeon cards were top quality. It offered crisp pictures, and smooth gameplay, to support my career as online gamer in the Unreal Tournament clan The Viper's Nest.

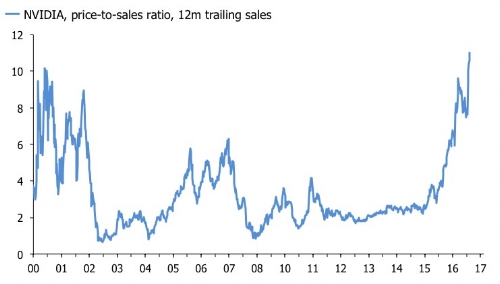

The world has moved on since then. I am no longer as adept with an Instagib rifle as I used to be, and NVIDIA no longer only relies on selling graphic chips. Today the firm is centre stage in the debate on whether U.S. tech stocks—and the infamous FANGs—are in a bubble. I concede that I don't completely understand why investors have suddenly decided that NVIDIA is morphing into Skynet 2.0. But it appears to be something about offering AI data center services to the likes of Facebook, Amazon and Alibaba to store and train their AI algos. Cut through the Terminator references, and the story seems pretty simple. The FANGs are the big kids on the block, and NVIDIA has managed to create a service they want, or perhaps even one they need. That's a good business model. Investors love it, and they are paying up. I had one of my agents on the buy side send me the latest bull-report from Citi. The bank's bull case for NVIDIA is $300, a cool 100% upside from the current level. The chart below shows that NVIDA shares are trading hands at a price-to-sales ratio of a dizzying 11 times, slightly above the ding-dong highs immediately before the dot-com bubble burst.

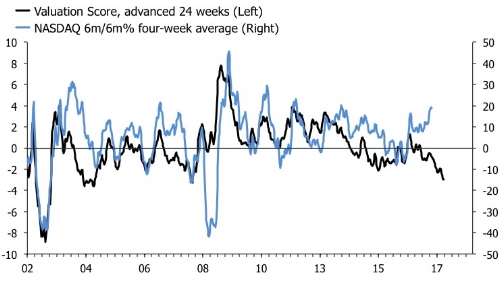

This is ominous for momentum chasers, but not necessarily conclusive. Shorting a chart like the one above can be very bad for your financial health, at least in the near term. More generally, it is possible that NVIDIA's drive into AI data centres is indeed the new black, but I am not sure that I want to pay 11 times trailing sales for the luxury of owning that story. Even tech firms with good businesses were destroyed when the tech bubble unravelled in 2000. The picture for the Nasdaq as a whole is more complicated. The index is expensive based on its own history. It currently trades at the same multiples as it did just before the 2008 crash. But first chart below shows that the index' price-to-sales is also well below the lofty levels in 2001 before the denouement. If this is a repeat of anything close to the Dotcom surge, the Nasdaq has a lot further to run. On the other hand, if I run it through my trusty valuation score, the message is to steer well clear of adding exposure.

Friday's price action in the tech high fliers certainly suggest that a sell-off is brewing. My Twitter feed is alight with technical analysis gurus predicting all kinds of fire and brimstone in the coming week. The Friday candlestick charts look ugly, I will give them that. If the FANGs and their ilk step back, you would think that equities as a whole would wobble. This sounds like a familiar—and wrong—refrain, though, doesn't it?

Elsewhere next week, the Fed is widely expected to raise interest rates, but the outlook for the rest of the year is what really matters. In last week's missive I laid out four scenarios for the U.S. bond market. A hawkish FOMC, which signals that they remain in three-hikes-a-year mode could force further flattening. But if they step back, I reckon two-year yields would ease and 10-year yields move higher. At least, this is the playbook bond markets are taking its cues from at the moment. The "parallel" shift higher is also a possibility, but we probably need to see stronger hard data in Q2 and Q3 for that story to come into play.

Finally, there is the balance sheet, which is understandably getting a lot of attention. I think everyone agrees that the Fed will move slowly here. The memory of the Taper Tantrum is, after all, still fresh. But the other question is really whether we should worry about a surge in yields as long as the ECB and the BOJ are sending swathes of excess liquidity abroad. Indeed, China also still runs a CA surplus and needs to buy U.S. debt to manage its FX policy, even if there has been more selling than buying recently. Finally, if the Fed begins to unwind its balance sheet late in the cycle, when the economy is starting to lose cyclical momentum anyway, it stands to reason that the private sector should be happy buyers. At least, this is what the textbook cyclical behaviour would suggest.

Strong and stable no more

I laughed when BBC's general election exit poll landed on Thursday. It was laughter fuelled by schadenfreude. I think Brexit is one of the most stupid political decisions ever made, and quite frankly, I wish it would just go away. To see Mrs. May fumble her attempt to secure a mandate to "drive a hard bargain" with the EU—in case you have been hiding under a rock, the Tories' lost absolute their majority—was pure joy. The reality is however that Brexit is not going away, so the feeling has proved short lived. It is too soon to make any assumptions about how the result change's the U.K. negotiation stance, if at all. For starters, I doubt that Mrs. May will be the Prime Minister tasked with taking the U.K. out of the EU. She emerged as a defeated figure when she announced that nothing would change, and that she would seek to form a government with the DUP. I think the daggers will be out soon.

The experts' reading is that the DUP will push the government toward a soft Brexit because they want to avoid a hard border with Ireland. But these guys don't strike me as "soft" at all. It is easy to imagine a world in which Brexit becomes a weapon of political mass destruction as an emboldened hard-Brexit Tory majority take over, while DUP jockeys for its specific aims with respect to the Irish border. Of course, there are other more benign potential outcomes too. I hope that's where we end up. The real insanity here is that the government in Westminster now has to contend with a situation in which Northern Irish unionists potentially can veto any domestic legislation in favour of their agenda closer to home. It is difficult to see how that works until 2022.

It is also possible that May's fall from grace wasn't about Brexit at all. After all, it is not as if she ran a smooth campaign on the domestic issues. That said, I struggle with the idea that Jeremy Corbyn has now suddenly morphed into a serious politician. I think the guy is a plonker. His rise in the last few months is not due to any material change in his conduct and policies, but mainly because of Mrs. May's disastrous election campaign. I think the Labour manifesto reads like a science fiction novel, and that it would be impossible to implement without throwing already fickle public finances into the toilet.

You have to feel for the quintessential foreign financier in London these days. If the extreme Brexit Tories get their way she could be kicked out, and if Labour gets the keys to the castle, she will be taxed into oblivion. In Kensington, it appears that Corbynomics was preferred to the spectre of a hard Brexit. Maybe turkeys do vote for Christmas after all?

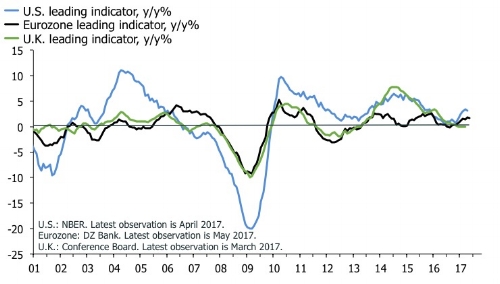

Whatever your political persuasion, however, it is pretty clear that Old Blighty faces some serious political and economic choices in this parliament. Adding insult to injury, worsening economic conditions likely are about to up the stakes. The chart below shows headline leading indicators for the U.K., the U.S., and the Eurozone. Spot the one that is now falling year-over-year.

As a resident in the U.K., I take no pleasure in that outlook. The U.K. economy has been a positive outlier in Europe since 2008, in part because it avoided the hit from the EZ sovereign debt crisis. In doing so, it provided jobs and growth in a situation where many economies on the Continent were struggling. It's funny how the combination of labour mobility and a free market for people, goods and services can be a force of good isn't? The U.K. economy was always going to slow, eventually, as momentum in credit growth slowed. But the positive momentum now appears to have come to a screeching halt, in the main because of the Brexit referendum. The world will move on, despite Brexiteers' desperate attempt to put this little island at the centre of the universe. But the choices which face U.K. politicians are not unlike what their colleagues in the U.S. and Europe are grappling with. Hard choices must be confronted by politicians and electorates alike. In comparison, the choice facing investors in NVIDIA and U.S. tech stocks is much less consequential, but they too likely will have to make big decisions soon.