It's all relative

Volatility returned to equity markets last week, but it was a quick visit. The S&P 500 slid 1.8% on Wednesday, the VIX jumped and babies were thrown out of with the bathwater in Brazil. For a short while, it looked like a significant chink in the armour, but this market is not easy to bring down. Equities snapped back at the end of the week and volatility receded. On the week, the S&P 500 ended down 0.4%—after a 0.3% decline the week before—just about the same as the MSCI World. One of the main debates on the Tee Vee Thursday morning was whether this "pull-back" marked the beginning of the big kahuna sell-off and a global recession. When the market goes up, we cry foul due to high valuations and tentative evidence of "bubble behaviour," and when it finally stumbles it stands to reason that it must the beginning of the big unravelling. I can't refute the internal consistency of this argument, but I am pretty convinced that the resilience or this meme is one of the key reasons why equities have been able to withstand just about anything bears have thrown at them.

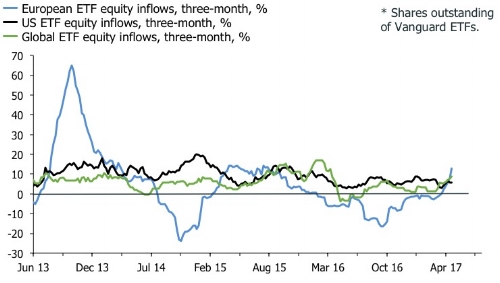

The good news for the bulls is that it makes absolutely no sense to talk about a recession inducing sell-off given the price action last week. The bad news is that it can get a whole lot worse in the short run without altering the underlying story. But investors and markets need narratives to get up in the morning. The dumpster fire of Mr. Trump's presidency has been identified as the main reason for the combination of struggling equities—with underperformance in the U.S.—and a weaker dollar. The first chart below, which shows that specs are now net long the euro, has been going the rounds. The second chart shows that trailing equity inflows—proxied by Vanguard's country/region ETFs—have pivoted recently in favour of Europe and emerging markets over the U.S.

I am a big believer in the idea that narratives drive markets, and the charts above hint at a significant change. They suggest that the "Trump reflation trade" has been replaced by an "overweight Europe/EM trade" implying that buying non-US equities, and selling the dollar, is now the sweet spot. This story has been boosted by the victory of Mr. Macron in the French presidential elections, and the increasingly desperate situation for Mr. Trump in the White House. We started this year with the notion that the U.S. growth miracle was on track due to a swashbuckling no-bullshit presidency, while the EU/Eurozone was on the brink of collapse. Nearly six months in, however, continental Europe is a beacon of political stability while the U.S. sinking into a quagmire of a dud presidency.

It is certainly true that Mr. Macron is not about to take France out of the Eurozone and the EU; on the contrary he wants to strengthen the French participation. I am also not worried about Italy as long as France and Germany rally around the project in the core. It will be Berlusconi 2.0, at worst. The problem I have, however, is that the Eurozone overweight story already looks stale to me. Contrary to nervous economists and political commentators, equity markets decided a long time ago that political risks didn't matter in Europe. I struggle with the idea that overweight Europe is the new black in equity land. Portfolio managers have already bought this story, and it looks fully priced in.

The counter argument is that we're on the cusp of a more durable trend in which Eurozone equity valuations and earnings finally catch up with the U.S. If this is true, the recent push higher in EZ equities is merely the beginning of more sustained period of outperformance. The chart to support this argument looks something like the one below, which shows relative performance between equities in the U.S. and Europe.

I have pushed against this idea not so much because I doubt the ability of Europe to defy its critics. I think Europe's political and economic institutions are far more durable that the naysayers think. Instead my objection to the hopes of a durable European equity resurgence is because such hopes are being kindled at a time in the cycle where—like Mr. Trump—it is more difficult to surprise. In the chart above for example, the last time trailing relative returns in Europe were this low occurred close to the ding-dong highs of the dot-com bubble. Investors need to careful about what story they're buying if they're piling into EZ equities on an absolute basis. Put differently, when investors are currently "overweight" Europe, does it mean that they're short U.S. equities in effect holding a risk-neutral portfolio. I doubt it. Instead, they're betting on a specific situation in which U.S. equities move sideways, which allows Europe and possibly the rest of the world to catch up.

I have also argued that the idea of Eurozone equities "catching up" is really a call for financials to rise from the ashes of the financial and sovereign debt crises. This is certainly happening—to some extent at least—but other cyclical sectors in the Eurozone are not cheap in an absolute sense, and certainly not relative to their global counterparts. The chart below shows the percentiles of the price-to-sales ratios of the MSCI US, the MSCI EU ex-UK and the MSCI EM. Eurozone equities are already close to historically high valuations based on this measure. This picture would change if we looked at price-to-book ratios, but that multiple is skewed by the low multiple price on financial book values, restoring my main point. If you're buying the re-rating of EZ banks, I am all for it, but don't tell me the rest of the market is cheap.

A similar argument can be made in emerging markets. Investor extraordinaire—but Twitter novice—Jeff Gundlach made a splash recently when he proclaimed that investors should short the S&P 500 and go long MSCI EM. As Bloomberg Gadfly columnist Nir Kaissar points out, though, this "pair trade" doesn't really make sense except over a relatively short time frame. Similarly to the story of Eurozone equity outperformance, investors need to think about what they're actually buying here.

I am sympathetic to the idea of a sustained rally in EM equities, mainly because many EM's are either mid-cycle or just about coming out of recession. But let's not kid ourselves. The clusterf'ck in Brazil last week shows us that EM institutions remain fragile—and that markets are sensitive to this—and we also have to question China's ability to goose its economy to sustain growth and credit creation. The MSCI EM is up 40% in dollar terms since the first quarter of 2016, well ahead of the paltry 26% rise of the S&P 500. I am not saying that EM equities can't run further. After all, the MSCI EM's post-crisis peak lies all the way back in 2011. But don't tell me that this story is new. When fears of Chinese devaluation hit markets in Q1 2016, it took bravery and thick kevlar gloves to buy. Now, I am not so sure.

Not all stories are made alike

The most important rule in navigating equity markets in this cycle has been to cut away the extremes. One part of the market continues to live in constant fear of a crash, while the other is convinced that buying every dip and selling vol can never go wrong. The latter has had the upper hand recently, but both of these positions expose portfolios to avoidable risks in the contexts of a plethora of opportunities elsewhere. Exploiting the divergence between sectors and countries have been a good way to say sane in the face of the binary story that markets either go up in a straight line or crash back to their 2008 lows.

In this spirit, the idea of Eurozone and EM outperformance is a good fit. But not all stories are made alike. The prospect of relative outperformance isn't enough; we need some degree of absolute value too. In the beginning of the year, I touted defensive sectors and duration in the U.S. not just because of their relative value, but also because they looked a good bet on their own merits. I don't think that's currently the case for EZ and EM equities—at least not on any traditional strategic timeframe—which implies that we should run a short U.S. equity position to capture whatever "alpha" the trade will deliver. I doubt many investors are doing that. This means that the idea of outperforming EZ and EM equities becomes a poor excuse for chasing risk assets. It could be a dangerous one too if volatility creeps higher over the summer, but to some investors I guess everything is relative.