Do or die for the Reverse Twist story

Investors are beginning to get seriously interested in the idea that the BOJ and the ECB will change the composition of their bond purchases to steepen the yield curve. In effect, this would be the opposite of the Fed’s Operation Twist, which saw QE purchases concentrated on the long-end, chiefly to lower the yield on mortgage-backed securities. I think this story, at least partly, is to blame for the recent nudge higher in global bond yields. But we will know soon enough. This week's BOJ meeting should give us a hint of whether this narrative has any legs.

The main idea of such a policy would be to ease the pain on the financial industry from flat yield curves and low rates. This is commendable, but creates issues too. The whole idea of concentrating QE purchases on the long end is to reduce roll-over risk for the sovereign, and allow the government to lock in low rates. For governments in the Eurozone and the Ministry of Finance in Japan, this makes a lot of sense given the implied burden on their finances due to population ageing. In the main, a Reverse Twist—if taken to the extreme—creates re-financing risk. In the Eurozone for example, the surge in yields on short-term peripheral debt , and the associated higher cost of rolling government debt was one of the main drivers of the 2011/12 debt crisis. But if the ECB and BOJ expect to be doing QE for a while, as I am sure they do, then perhaps that isn’t such a big problem. In the end, they are simply discounting the reality that they will be a key part of re-financing any short-term debt that comes due.

A more aggressive alternative would be if the BOJ shifted its purchases of long-term debt into foreign bond markets, but I suspect this would very quickly become a hot potato in the G7. It is one thing to recycle your external surplus into Apple shares, U.S. REITs, and retail shops on Oxford Street. But printing domestic currency to buy the long-end in the U.S. and the U.K. would be tantamount to a currency wars nuclear strike. It would not go down nicely I think.

Tit for tat, and suddenly globalisation is in reverse

I wasn’t the only one struck by the similarity between the $14.5B fine levied against Apple by the EU Commission, and the $14B Sword of Damocles Deutsche Bank now have hanging above their head in the U.S. due to their naughty business with subprime mortgages. Coincidence? I’ll just about go with that, but it doesn’t look good. There is no better way to describe this than Macro Man’s version of the song, Anything you can do, from the 1946 Broadway musical, Annie Get Your Gun. It ranks among the gaffer’s best yet, so be sure to go check it out.

This isn’t all fun and games, though. Global trade volumes are falling, and the reversal of globalisation is not only a threat, but also increasingly a reality if you listen to the told by investors and economists; narratives matter. This partly is globalisation’s own fault. A growing share of the middle class in the OECD is being left behind, and we see clear signs that people are using their right to vote in a way which has little to do with what economists would argue is in their “best interest.” In principle, that is not a catastrophe. After all, politics and economics are separate animals altogether. But I cannot help but feel it is also because many workers, politicians and investors have come to expect too much of a system which, in the main, is working as well as could be expected. In addition, the second part of this story is the scary reality that those who want to kick up a fuzz and change things, offer little in the way of an alternative.

The huge fines dished out to VW and Deutsche Bank in the U.S. offer a perspective on the story of a reversal in globalisation. Sure they have been naughty, but it is not unreasonable to expect some European firms to leave the U.S. altogether if this continues. The cost will be fewer jobs in Europe/the U.S., and fewer choices for the U.S. consumer. The same argument can be made in the case of Apple of course. Firms whose business and core competencies are built on the exploitation of global economies of scale, and their investors, would be in for a rude awakening if recent trends are taken to the extreme.

Equities are rolling over, but easy does it

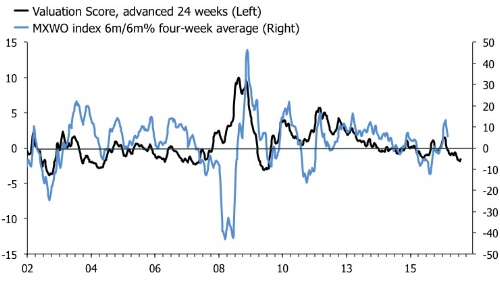

In markets, the hiccup in bond markets have pushed volatility higher in equities, but the damage has so far been relatively modest. The Dow and Spoos are down 2%-to-3% from their highs, and we have seen similar moves in Europe. I stand by my call, however, that things will get worse before they get better. My next chart shows the latest update of my valuation model for the MSCI World, and the key bit to notice is that returns have rolled over.

This is in line with the model, and if you believe it, further downside is likely. If we take the model by its word, it currently predicts weakness into mid-October, a small rebound, and then a more severe sell-off into 2017. If that proves correct, it would go a long way to suggest that the seasonality of the market has changed following the "unexpected" and severe swoon of the markets in Q1 this. Normal disclaimers apply of course. Such an accurate prediction of the market's twist and turns on a six-month basis is highly uncertain. But at least its a game plan.

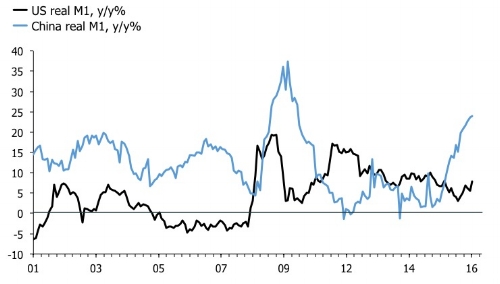

Meanwhile, outside the world of meteorology-like market forecasts, I note that U.S. real M1 growth has accelerated recently. Money supply is less perfect as a leading indicator in the U.S. than it is in the Eurozone, but I would be much more worried about the recent soft data in the U.S. if M1 growth had continued to trend down. The Chinese money supply chart still implies that milk and honey awaits investors in EM equities, but my bet is that we will get the opportunity to buy it lower.

Finally, work has begun on part 2 of my macroeconomic history podcast. I have tons of reading to do, though, to get it right. So allow me some slack. I will get there in the end.