Much ado about nothing

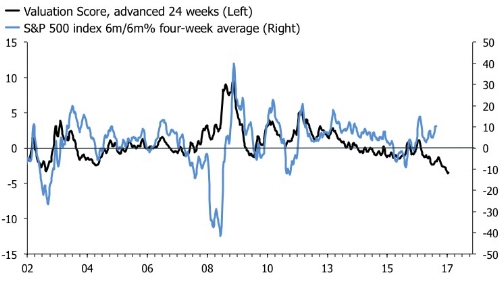

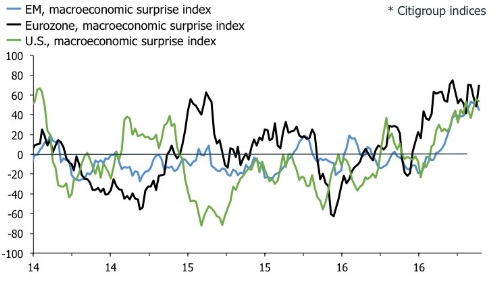

I am short on time this weekend, which is probably a good thing given that I have really struggled to share the excitement over last week's events. We had the swoon of the S&P 500 and its first 1% daily decline in more than <insert number here> days on Tuesday. Overall the index had temerity to post a 1.4% decline on the week, the biggest fall since the first week of November. It was with a tinge of embarrassment that I watched the overreaction of my fellow equity investors on both sides. For the bulls, this was the buy-the-dip of a lifetime and for the bears it was the signal that the bull market had come to an end. In truth of course, it was evidence of neither, although I suspect that the bulls will be the ones sleeping with most unease. Quite simply, they have the most to lose if equities suddenly decide to trade on a different theme than the higher growth/reflation story. A flattening yield curve has been an important early sign in my view, and if equities "catch up" with that story, a plethora of models suggest that the adjustment could be rather brutal. The first chart below of my valuation score relative to trailing returns on the S&P 500 is a case in point. The second chart shows macroeconomic surprise indices for the major regions. If the narrative shifts here, you would imagine that it would shift quickly.

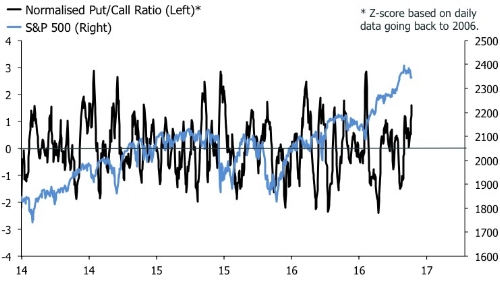

The news is not all bad for the bulls, though. Fear is easily stirred up in this market. The put/call ratio on the S&P 500 has jumped to within a whisker of extreme territory even though the market has barely moved. I find that quite extraordinary.

Finally, we had the flurry about the healthcare bill in the U.S. On the face of it, the failure of Mr. Trump and his team to push it through should bolster the confidence of those who believe that the Trump/reflation trade is running out of steam. But I really struggle with the idea of making decisions/trading on the basis of such events. Bloomberg's Cameron Crise had the key point I think, when he answered the rhetorical question of whether the vote—or non-vote as was the case—matters at all?

"On any sort of strategic macro basis, the answer is also probably “no.” Sure, if you manage health-care stocks, today is a big deal. Other than that, the failure or passage of the vote ultimately will say little about the prospects for tax reform, which is the issue of most concern to financial markets."

I concur. I am long healthcare stocks mainly due to their defensive properties but even with this position I struggled to get excited. It would have taken a long time to agree on and implement all the details of this kind of legislation even if Mr. Trump had managed to secure a victory for his bill. In addition, I fail to see the news value in the fact that the new U.S. administration is facing difficulties pushing its ideas through Congress. Drawing up all manners of executive orders is one thing, but actual proper legislation is quite another. It was always going to be a train wreck when Mr. Trump had a go at the latter. Mind you, despite the fact that I don't like Mr. Trump and his team, I don't think this is a good thing. A U.S. administration that can't push through legislation in Congress is a weak one, which will lash out via more inept executive orders or silly foreign policy stunts to compensate for its inability to govern. For now though, Mr. Trump's administration, like the recent dip in equities, is turning out to be much ado about nothing.