When your dry powder is drenched by the forex

What a week it has been here in the U.K. The turmoil at Deutsche Bank was set to remain the topic du jour. But Prime Minister May's promise to trigger Article 50, and the remarkable party conference in Birmingham, took centre stage. Another Bashing Betty session ensued, which reached its zenith overnight Thursday as GBPUSD was pushed to 1.14 on some platforms before recovering to about 1.22-to-1.24. A fat finger, corporate hedges hitting "stops", or a systemic lack of liquidity; take your pick in terms of rationalisation. I think the whole thing is absolutely ridiculous, given that this is a G4 currency.

The rhetoric by the new Tory doyens was startling, and as I type this, the back-pedalling has already started. In any case, I have a podcast about the whole thing, which you can listen to here.

Elsewhere, the carnage in sterling is a nuisance to me. I am a GBP earner, and my portfolio is held in GBP. In short, foreign assets now look dreadfully expensive unless you start trawling for the turds of the turds. I try not to rely too much on hope in my investment decisions, though. I am open to local-currency opportunities in the FTSE 100 and 250, but I am not finding that much to be excited about to be honest. In short, I am not doing that much.

Longs in Gold, commodities and selected EZ and U.S. equities have protected my purchasing power nicely this year. But I shed my foreign equity exposure too soon—evidently, given the sucker punch from GBP last week—and my current substantial cash position does not feel like the "dry powder" it is supposed to be when I look at the price I am paying for the assets outside the U.K that I like. If that ends up being my only worry in Q4, though, I suppose that I should count myself lucky. Finally, the flipside of this story is that EUR-based portfolios and investors currently have very juicy pricing power in U.K. markets, and I think portfolio flows and M&A activity will reflect this in the coming year.

Looking beyond the swoon in GBP, the MSCI World continues to churn, and has now been stuck in tight 3% range since the middle of July. My bias remains that it will break lower, and that investors are best served by waiting or shorting global beta. The EURUSD is another bellwether for markets, trading in an impossibly tight range at the moment. Interest differentials point to a break to the downside, but the CA surplus—and the experience in Japan—suggest that it could easily zoom higher to 1.20ish, or even beyond. I think the range will crack soon, and it will be fascinating to see which way it decides to go.

Elsewhere, crude oil was denied a break above $50 last week and for now, it looks like the $40-to-$50 range established in June will hold. To be clear, though, I think the pain trade here is a break higher. 10-year bond yields in the U.S. are creeping higher, and I suspect that trend will continue. Put simply, I think the market is underestimating global inflation risks, but I face stern opposition on this call. HSBC's resident bond bull has pencilled in a decline in U.S. 10-year yields to 1.35% next year. That kind of divergence in opinion, ladies and gentlemen, is what makes a market.

I am currently focused on three existing, and potential, stories in markets.

The global non-financial corporate bond bubble - Generally, I tend to read Albert Edwards a bit like I would read a work of fiction from an author that I really like. He tells great stories, but they never come true, and I continuously need to remind myself that when one of his pieces floats into my inbox. By the way, I feel the same about John P. Hussman. That said, I think Mr. Edwards' recent bear-note on alarmingly high corporate leverage is on the ball. I have discussed this topic before, and I think that a global "Lehman Moment" is much more likely in corporate bond markets, than it is in the ailing EZ banking industry. The build-up of leverage in the U.S. non-financial corporate debt market is the key focus here, but just imagine what would happen in the Eurozone if the ECB decided to kick back from the table and stop buying corporate bonds?

Source: Morgan Stanley, Soc Gen, and ValueWalk

There are two aspects of this story, which should worry markets I think. Firstly, timing a "liquidity event" is impossible but let us compare the situation in this market with what just happened with Cable. One of the arguments for why the air pocket was so big for the GBP is that liquidity has structurally declined in FX markets in recent years. How do we think that a similar "air pocket" would be resolved in corporate bond markets given the horrible mismatch between the reach for yield and regulatory change that has lowered corporate bond inventories of traditional market makers. I think it would be ugly, and I think it could easily spread to other markets. In addition, as I have pointed out many times, central banks have all their liquidity guns pointed at the interbank market, but not at the new shadow financing market where new huge bond funds and ETF providers are the big players. I am pretty convinced that this where the biggest systemic risks lie for global financial markets.

The second aspect is that equity markets are vulnerable, I think, to a switch in focus towards balance sheet risk. As long as rates are low, and the hunt for yield is on, such a switch is unlikely. But it'll happen eventually, and when it does there are a lot of turds out there. I had a go at one here, and for the record, I remain short. Conversely, unlevered equity could soon be in vogue and I intend to choose my long equity positions accordingly. I have no illusions, however, that I would be unharmed if the worse case scenario should unfold. But if you don't have debt, the risk of bankruptcy is lower, and this could turn out to be a key metric when the next global denouement happens.

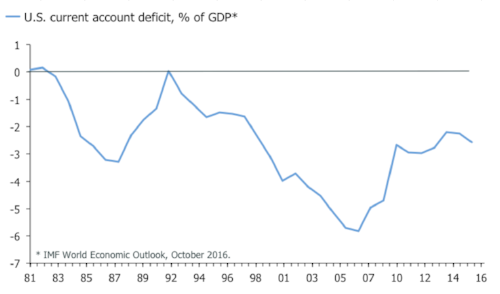

A USD bull market and Bretton Woods III - The GBP's fall from grace has put further spotlight on the USD and the Fed. The euro is weak and the ECB arguably wants it weaker, the Yen is uncomfortably strong for the BOJ, and EM currencies also are historically weak. In combination, and forgetting about exceptions to the rule in Australia and New Zealand, this feels an awful lot like the opening gambit of a Bretton Woods III story. In short, the FOMC does what it needs to do given the domestic economy, the USD strengthens, and the U.S. current account deficit widens and global asset markets ride into the sunshine, carried by strong U.S. growth. In this world, we will all be lifted by the combination of the U.S. economy, once again, taking on the role of global consumer of last resort and the plentiful availability of global excess liquidity to make this possible. Remember here that when the U.S. current account deficit expands, it means that the amount dollars globally is increasing, which usually has been associated with milk and honey for global asset markets.

Now, this story clearly is wildly inconsistent with a business cycle that is long the in tooth, at least outside EMs, and with a lot of leverage already present in corporate bond markets. As such, let me present the narrative as follows. If we are to extend the global bull market in debt and associated risk assets, a wider U.S. current account deficit is the only way that can happen.

Commodities, EM and higher global inflation - Let's assume for a minute the global corporate bond market does not blow up and that Bretton Woods III is not around the corner just yet. In other words, what are the most attractive themes given a continuation of a "middle-of-the-road" range-bound market? I think the evidence overwhelmingly suggests that the business cycle in key G4 economies is in the latter stage, which means that inflation risks are under-priced. This suggests that bond yields should go up, and that hitherto underperforming financials and insurance equities should outperform. In addition, I think that EMs and commodities have de-coupled from the cycle in the G4 recently, which suggests that these assets could well outperform even as economic conditions deteriorate, and political uncertainty, rises in the major developed economies.

Before you label me schizophrenic, I know that the thematic stories highlighted above can't all be true. But I think it is important to be open to different and even contradicting stories at the same time. If I knew exactly which story that would prevail, the whole thing would be very easy. But it isn't. Reality in financial markets seldom conforms to what appears obvious. When it hits, more often than not, it feels like being drenched by a bucket of cold water.