Italy's Time to Shine?

Italy's long-term growth prospects remain dire if judged through the lense of historical productivity growth and the future rapid ageing of the country's population. In fact, any reasonable estimate of Italian trend growth is probably below zero simply because the data don't allow you to work with the assumption that productivity growth can compensate for the drag from a declining working age population.

The country's prime minister Matteo Renzi is, as you would expect, optimistic and recently introduced the idea that Italy could become the Eurozone's growth locomotive in the next ten years. Alessio Terzi from Brueges acknowledges the President's upbeat sentiment, arguing that Italy is indeed about to surprise to the upside.

Important reforms put in place over the past months, combined with a conjunction of particularly supportive external factors, mean that Italy could indeed become the fastest growing large economy in the euro area in a not-too-distant future.

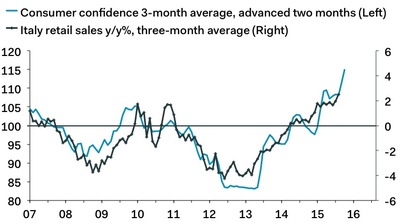

I am deeply skeptical that run-of-the mill economic reforms can halt ever rising goverment debt and the drag from a broken population pyramid. Cyclically, however, the soothing effect on bond yields from QE , low energy prices and an external surplus suggest that upside surprises in the Eurozone are indeed likely to come from Italy in coming quarters.