Economic Data from France

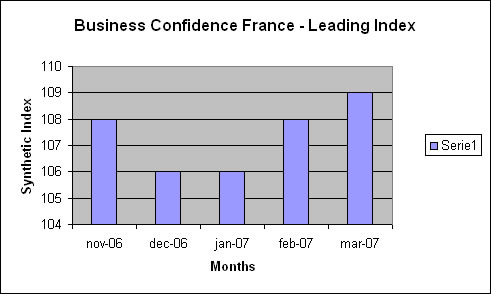

The French statistical office has just published data on business confidence in March and consumer spending in February. Concerning the former, the business confidence index rose in February albeit only slightly from 108 in January to 109. Below is the round-up in French but I have also plotted the recent 5 months' development of the leading index in Excel to give the non-francophone readers and idea of what we are talking about.

Les chefs d'entreprise interrogés en mars 2007 font état d’un raffermissement de la conjoncture industrielle.

L'indicateur synthétique du climat des affaires s’inscrit en légère hausse. D’après les entrepreneurs, l’activité passée a progressé dans l’industrie manufacturière. Les stocks de produits finis sont estimés proches de la normale, même s’ils remontent un peu. Les carnets de commandes demeurent bien étoffés, en hausse pour les carnets globaux, en légère baisse pour les commandes étrangères. Ainsi, les perspectives personnelles de production restent favorables. Les perspectives générales de production sont stables. De même, les perspectives des industriels en matière de prix de vente apparaissent inchangées.

Concerning the latter, consumer spending appears to have dipped in February although the break up provided by INSEE reveals mixed results. Spending on manufactured goods dropped 0.4% in February after a 1.0% increase in January and likewise with spending on durable goods which dropped 0.8% in February after an increase of 1.4% in January. The drop in durable goods is attributed in particular to a strong drop in the purchase of housing equipment which dipped 1.6% in February after an increase of 4.1% in January. On the other side for example, the sale of automobiles rose sligthly from January.

So, what can we deduce from this number and data crunching? At this point, not a whole lot I would say. Consumer spending will be interesting to watch of course and if the overall downward is sustained into April and May we I would argue that we should begin to see an effect on Q2 q-o-q GDP figures although this is of course way too early to tell. Whether business confidence will stay afloat will of course depend on the news coming out of the US where I think the sensitivity is very high at the moment.